The debate on digitisation often revolves around the risks. The opportunities tend to get overlooked. But digitisation and DLT in particular are creating plenty of opportunities for the Swiss financial industry. The authors of the research see especially good potential in three areas.

First, if it manages to position itself internationally as a pioneer in trading tokenised securities, Switzerland will be able to expand its relatively small capital market. The cost savings resulting from the use of DLT as a kind of by-product also make the Swiss capital market generally more attractive for domestic and international issuers.

Second, DLT can be profitably harnessed in trade finance, where transactions involve many different steps and parties. The new technology will make the relevant documents accessible to everyone concerned at all times, without a great deal of administrative work and expense.

Source: “Building Blocks – Tokenisation & the Blockchain Evolution”, Crypto Finance (2019)

Third, the technology will enable wealth managers to exploit new business models and client segments, for example in the safekeeping of the private keys required for access to any DLT system.

Useful groundwork has already been done in all these areas in Switzerland. But the time for pioneers is over: Switzerland now has to take the next step in the development of DLT, morphing from the much-vaunted “Crypto Valley” into a fully-fledged DLT nation.

Today’s monetary system

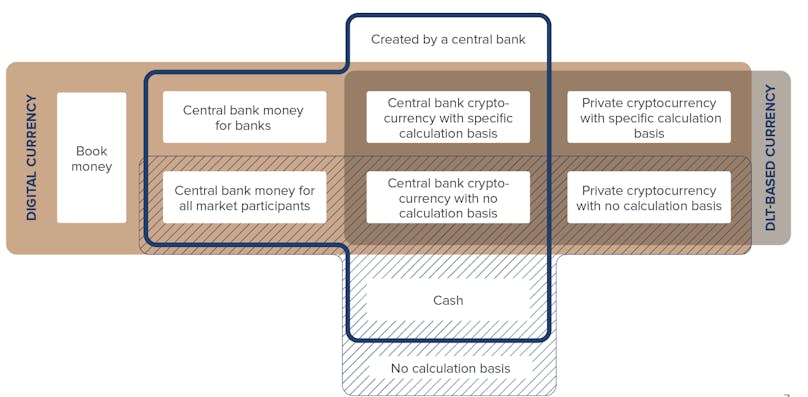

Already today, our system consists of digital money to a large extent. Banks have access to digital central bank money, the so-called demand deposits. This money is transferred centrally via the central bank. Central bank money, i.e. the money supply in the narrower sense, is made up of cash in circulation and sight deposits held by commercial banks in current accounts with the SNB. However, this is only a small part of the money supply in the broader sense. The remainder, much larger in terms of volume, is the book money drawn by commercial banks in connection with lending, which exists purely digitally and is also accessible to the public (SNB 2018a).

Different kinds of money

Source: “Building Blocks – Tokenisation & the Blockchain Evolution”, Crypto Finance (2019)

Money can be categorised according to four dimensions: through authorisation – whether access to this type of money is given for all or only for a limited group of users; through its form – whether money is physical or digital; if money creation is with the central bank or with private actors; and whether money transfers are centralised or decentralised (DLT-based).

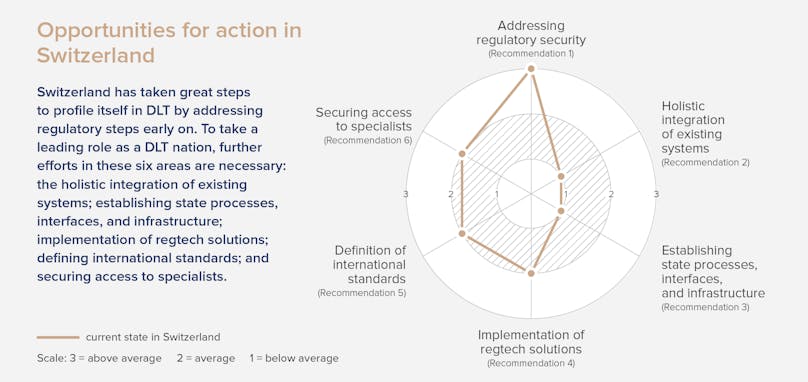

The path to becoming a DLT nation

The Swiss financial industry needs an optimum framework to hold its own in the DLT arena. Action is required in the following areas.

Public vs. private sector: It would facilitate tokenised securities trading if the National Bank and major players in the industry were to drive the development of a Swiss franc token. There is also a serious need to modernise the interfaces between the public and private sectors, for example e-ID and the registry of deeds.

Regulation: A major challenge will be to strike a balance between legal certainty and lean regulation. Essentially, the law should be changed only in areas where it is not yet DLT-compatible. But these changes have to be made as soon as possible. Regulation should be made that is technology neutral. Wherever possible and reasonable, FINMA should also be exploiting the potential of regtech more fully by making machine-readable regulation available.

International relations: A major challenge will be to strike a balance between legal certainty and lean regulation. Essentially, the law should be changed only in areas where it is not yet DLT-compatible. But these changes have to be made as soon as possible. Regulation should be made that is technology neutral. Wherever possible and reasonable, FINMA should also be exploiting the potential of regtech more fully by making machine-readable regulation available.

The Swiss financial industry is traditionally very international. There is also mounting global competition in the DLT arena. The employment market has to be kept open and attractive to people from abroad. This particularly applies to people from other countries graduating from Swiss universities, for which the quota is much too small at present.

This article was first published in: “Building Blocks – Tokenisation & the Blockchain Evolution”, Crypto Finance (2019).