In the aftermath of the Brexit referendum in 2016, many Swiss hoped the outcome would improve their own country’s position in its negotiations on an Institutional Agreement (InstA) with the European Union. Forecast EU concessions UK would also benefit Switzerland, it was hoped. Some even tipped the “EU rebel” Britain rejoining the European Free Trade Association, alongside co-founder Switzerland.

In retrospect, Brexit actually complicated Switzerland’s already tough negotiations with Brussels, and no Anglo-Swiss solidarity or united front against the EU was achieved. The EU has stuck to its principle that any third country seeking access to the single market must respect EU rules – “my house, my rules.”

With this in mind, it is astonishing how many tailor-made agreements Switzerland, in fact, has managed to reach with the EU since 1992. Bilateral relations are governed by over a hundred treaties. Over the decades, these have created a framework for market access for a third country that EU had never envisaged.

“If Brexit turns out to be a success, it will be the beginning of the end for the EU,” said Manfred Weber, Chairman of the EPP Group in the European Parliament. From the outset, the British side is rejecting EU standards for its future relationship with Brussels. The two sides are already marking out their ground. That means 2020 will be a key year for how Switzerland and the UK shape their future relations with the EU. But unlike Switzerland, the British are starting with a clean sheet of paper. Which of the two countries has a better chance of gaining concessions from the EU?

For EU companies, Britain is a market several times larger than Switzerland (see chart). Some 66 million UK consumers dwarf Switzerland’s 8.5 million. That imbalance is s also reflected in trade volumes: the EU-27 trades more than twice as many goods and services with the UK as with Switzerland. Because of Brexit, Switzerland has slid to fourth in the ranking of the EU’s most important trading partners, behind the US, China and the UK.

At first glance, Switzerland may well hold some trumps when it comes to the EU. However, it will not get a better deal by waiting. (Kowshik Roy Sagor, Unsplash)

The EU’s share in the foreign trade of Switzerland and of the UK is roughly the same: while 53 percent of Switzerland’s foreign trade in goods and services is with the EU, the figure for the UK is 49 percent, though likely to decrease because of withdrawal. It is the declared aim of the British Prime Minister to diversify trade through free trade agreements, with a prime focus on the US. Brexit could, thus, put a spoke in Switzerland’s wheels for a second time given that Bern’s hopes to reach an FTZ with the US now to prioritize a free trade agreement with the UK over one with the Swiss. Initial exploratory talks have so far not progressed.

At first glance, Switzerland may well hold some trumps when it comes to the EU: first, it has a current account deficit, i.e. it imports more goods and services from the EU than it sells. The EU, therefore, has a greater interest in market access than Switzerland. However, this argument is based on the outdated, mercantilist theory that surpluses are good and deficits are bad. After all, the decisive economic factor is not the maximization of the trade surplus, but the benefits from bilateral trade (see “Deficits Are not a Bad Thing Per Se”).

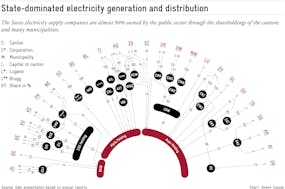

Second, it is often argued that Switzerland’s geographical location – in contrast to the UK – makes it a central hub for transit between EU member states. One might think of transalpine freight traffic or electricity supplies to Italy. This argument should not be overstated, however. Slowly, but steadily, the required infrastructure is being built, bypassing Switzerland. In the future, Switzerland’s geographical location will probably be less decisive.

The opposite applies to the UK. Firstly, the UK, and London as a financial center, will probably become a tougher competitor as a business location to the EU in future. Switzerland, by contrast, has lost importance as an international location, especially for multinationals and the financial sector – something that has not gone unnoticed in the EU.

Second, the UK is of crucial importance for European security policy. Through NATO membership, it remains linked to many EU states, though at EU level the British can no longer be counted in, at least formally. Switzerland has never had a similar position in Europe and will most certainly never achieve it in future times of risk.

So it is probably much less realistic for Switzerland to expect any further EU concessions. Switzerland’s economic and strategic importance for the EU is too different from that of the UK. The Institutional Agreement between Bern and Brussels, on the table for over a year, should be clarified in individual points. But hopes of untying the package or even a renegotiating it completely, in expectations of a better result, are illusory. Switzerland will not get a better deal by waiting. Switzerland is sovereign to sign the Institutional Agreement, but equally free to terminate it at any time. That means it is now opportune to secure long-term relations with Bern’s most important partner, the EU, rather than pursue any false hopes of something better to come.