In the past four to five years, there has been a rapid rise in so-called initial coin offerings (ICOs). This is a form of crowdfunding, through which start-ups raise capital by issuing their own digital tokens.

Broadly speaking, tokens come in three main types: payment tokens, utility tokens or asset tokens. Variations are also possible. Payment tokens (like Bitcoin) are pure cryptocurrencies, serving as means of payment and stores of value. Utility tokens provide access to a specific digital service (a typical example is the right to digital storage at the company issuing the token) Asset tokens represent financial assets, such as shares, bonds or even derivatives and are a sort digital security.

All are based on blockchain technology, involving a network of computers in which identical ledgers of the transactions initiated by the tokens are kept, thereby avoiding banks, clearing houses or other intermediaries. A single ledger held by a sole intermediary (such as a bank in the case of traditional lending) is replaced by a network of distributed ledgers, whose consistency is constantly monitored.

Blockchain’s appeal lies in the fact that execution is secure from the potential dishonesty or unreliability of an individual intermediary. Some have called it a “trustless” system because users of the technology are no longer forced to trust a single intermediary for execution. Due to the large number of identical ledgers, it is not possible to hack into a single ledger and forge a transaction without the resulting inconsistency with other ledgers being noticed.

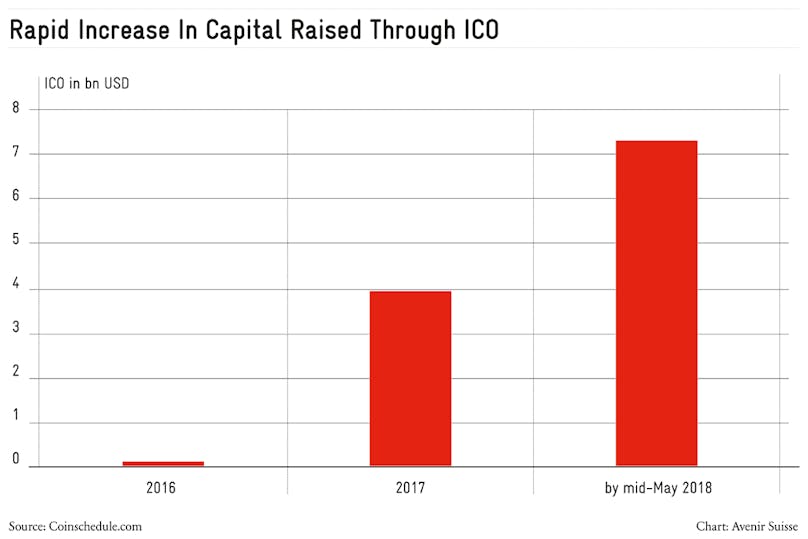

Rapid increase in capital raised through ICO

An increasing number of young technology companies are benefiting from ICOs as a new and inexpensive form of finance. According to coinschedule.com, a British portal systematically tracking ICOs since 2016, almost $3.9 billion was raised worldwide in 2017. This year has already turned into a record, with total offerings exceeding $7 billion by mid-May.

ICOs could have a bright future, especially for financing start-ups, which is otherwise not easy in Switzerland, and the country has become one of the two key issuing locations alongside the US.

Opinion differs on whether ICOs are a revolutionary financing tool, or the latest tech bubble waiting to burst. The gold rush mood has already attracted fraudsters: remember Blockchain protects only against scams by intermediaries, not issuers. And experience shows bubbles are hard to recognize until it is too late. So, investors should probably treat tokens with caution – although even traditional start-up financings tend to have high risk reward ratios.

Avoid choking new opportunities by clumsy regulation

Such concerns should not, however, prompt regulatory overkill (China has banned ICOs altogether) For depending on the economic function of the tokens, there may already be a legal framework in place: payment tokes, for example, are subject to money laundering rules.

That has already been the approach of Switzerland’s Finma financial markets regulator in a guidance note in September 2017 and in ICO guidelines a year later. Its “technology-neutral” approach is fundamentally sound.

Understandably, in the interest of legal certainty, further regulatory measures may benefit the promotion of a crypto-financial center in Switzerland. But, as with any new rules, the first question should always be whether a suitable regulatory framework exists already elsewhere and, if not, what new rules would be most favorable and least costly to businesses and customers. Moreover, every technological innovation raising regulatory questions represents another opportunity to consider simplifying the legal framework of the economic function it serves in general. Otherwise, we run the risk of prematurely suffocating the opportunities of new technology under an impermeable regulatory blanket.